This breakdown of my budget is so intense, you may know me better than my therapist does after reading it.

You’ll also know exactly how much I paid my therapist.

Ready?

This week, meet:

➡️ What 2 years of systematic tracking did to my finances

➡️ What I spent this year — in minor detail

➡️ What I spent this year — in excessive detail

What 2 years of systematic tracking did to my finances

I’ve become pretty dedicated to tracking my finances. It’s not even just because I’m a nerd. It’s because I’ve been seeing results:

It encouraged me to find ways to increase my income.

It enabled me to actually save a sizable amount of money.

It eliminated at least 90% of my anxiety about money (this is HUGE as someone who has historically existed at level 8-9 money stress at all times).

So, what’s the culmination of those 3 things happening over the course of 2 years?

Well, this:

I earned $55,778.19 post-tax in 2023. That’s an average of $4,648.18 per month. That’s also BY FAR the most money I have EVER made in my life.

My expenses in 2023 totaled $58,258.31, or $4,854.86 per month on average.

But hold up.

I made $55k… Spent $58k… Sounds to me like that “systematic” money tracking wasn’t very successful??? 🤨

Okay.

So maybe the “systematic” money tracking isn’t completely systematic.

But it WAS successful. At least, I think so. Why do I think so? This special fact:

I saved $28,397.58.

So that $2,000-something dollars between what I spent and what I made was me being a little willy-nilly about adding to my savings, then taking a bit back out later.

That willy-nilly-ness happens due to the by-far most important aspect of my system:

I actually do it, and it doesn’t drive me crazy.

If I obsessed over perfectly balancing money-in, money-out and tracking precisely how much came in and out of my savings account… That would probably drive me a little crazy. And, honestly, I wouldn’t do it.

So let’s split the difference and agree that I saved $25,914.46 over the year, to make up for that loosey-goosey-ness between expenses and income. (Btw, I did buy a house this year, so I put about this much toward a down payment.)

What I spent this year — in minor detail

Okay, we need to zoom in on that last number for a second because I’m actually stunned. I somehow made it through 2023 only spending around $29,800.

That’s only 53% of my total income I used to pay for stuff.

Granted, that’s still more than I earned in a year just a couple years, but still. And granted, that’s just about the same amount that someone on minimum wage in my state would have earned total pre-tax after working full-time in 2023.

Anyway.

If you’re the kind of person who thrives off graphs, today is your lucky day.

Here are my entire 2023 expenses in one giant snapshot based on the categories I use for my budgeting:

What I spent this year — in excessive detail

Now, if you’re a particularly nosy and/or data-oriented person, it’s about to get even BETTER for you.

Here’s a more granular breakdown of the 17 categories, including my reflections and added context on each area of spending.

Laid out from least-expensive to most-expensive:

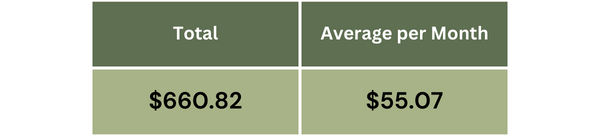

1. Phone.

I pay my phone bill ONCE per year. Shoutout Mint Mobile. (I switched from Verizon 4 years ago. I was paying $80 per month back then. Those were some dark times.)

2. Dates

Dates = more intentional meals or drinks out with my partner. A “want to go get sushi instead of making dinner” kind of situation doesn’t count.

And I tell you, my partner HOLLERED when she learned this was the category I spent the 2nd least amount of money in. 😬

In my defense, I didn’t start tracking this category until July-ish of this year. In her defense, she is worth the world.

3. Work

These are mostly subscriptions from software I used as a freelancer. Most expenses in this category are tax deductions. (Minus that time I included the drinks I had with coworkers that I was too embarrassed to expense on my work trip.)

4. Coffee

Bit of a Wild West, this category. Sometimes I put bulk coffee for home in this category, sometimes I put it in groceries.

But what I DEFINITELY put in this category was how many times I went to get a coffee when I lived across the street from a beautiful little cafe for most of the year. It was the only time I would get out of the house during my WFH workday, and I have no shame for how many Americanos are represented in this number.

5. Drinks out

Alcohol drinks out of the house, but not with friends (that one comes later).

Mixed feelings on this one… $500 seems like a LOT to pay for just alcohol. This does include mostly times I went out with my partner — to bars, or concerts, or other events. Also, there was a lot of variance here: some months I spent $0, some $100+.

6. Social

Here’s the part where I went out with friends.

This includes any money spent while spending time with friends — dinner at my house, bringing drinks to a party, buying my own brunch, etc.

Ever since the days when my budget was much tighter than it is now, I decided that intentionally setting aside money so I can do stuff with people is important to me.

7. Entertainment

Subscriptions, concerts, events, etc.

(You can pry my Spotify subscription from my cold, dead hands. By far the best $10.99 I spend every month.)

8. New House

I moved twice this year — once on January 1st, and again in October when I bought my house. (Have I mentioned that I bought a house?)

It seems like every time you live somewhere, you have a fully functioning household. Then you move, and suddenly you need a new shelving system, or a different trash can, or hedge trimmers (?), or a new chair. Or all of the above. So that’s what all this was. Most months were $0, some were $549.38. Give and take.

9. Gifts

Birthdays, Christmas, charities, and all that.

10. Eating Out

Eating out on a whim several times a month is new for me as an adult. Restaurant food has always been the #1 do-not-buy thing for me when I was broke.

Now? I like it when I’m eating DoorDashed Hawaiian food at 8pm. Don’t like it so much when I see it all added up over the course of the year. But it’s probably worth it.

11. Car

Gas + maintenance + insurance + registration.

I am STUNNED how much money I saved here this year. My car is paid off (and old), but this is BY FAR the least amount of money I’ve ever spent on it in a year.

I now work from home full-time, so she sits in the driveway and doesn’t ask for much these days. I have paid twice this total amount for ONE visit to the mechanic before for this very same car, so this year was her thank you for taking care of her in the past.

12. 🌈Therapy✨

I found a therapist I like who is – drum roll please – not covered by insurance. I decided it was something I want to prioritize anyway even though this number gives me heartburn. This is 2x monthly appointments since late July.

13. Miscellaneous

I use and abuse this category a bit more than I’d like.

It’s meant to be for random one-off stuff like parking tickets and Tech Decks, but I’ve been putting stuff like shoes and clothes here.

I’ve never bought those items frequently enough to warrant their own category. But that’s something I’ll change this year. I’m buying this stuff more often and would benefit from tracking it.

14. Trips!

I realized a year ago that going on little trips makes me really happy! Nothing crazy. Biggest trip was 5 days in Denver, smallest were camping trips, in between-est were 1-2 nights at an Airbnb.

15. Groceries

Rumor has it this was a HUGE cost for a lot of people this year. I’m lucky to split these expenses with my partner.

(But then we’re eating twice as much food, no? So doesn’t it balance out? This conundrum has always plagued me.)

16. Housing

First chunk of the year, this was rent. Last few months, it’s been a mortgage. (I bought a house, you know.)

I also include utilities in this price because I am the way I am and have a separate spreadsheet breaking down all housing-related expenses month-over-month.

17. Savings

The grand finale. I knew I was saving a lot of money this year, but my jaw dropped when I saw the final number all added up. (I’ll do separate breakdowns on how I did this, why, and exactly how much I put away to make it manageable over time.)

To be continued…

I love when people share a breakdown of their finances online.

The transparency helps me situate myself better financially, benchmark what I’m doing well and where I’m falling behind, and it feels kinda cozy and communal.

What I don’t love? When people act like their financial breakdown is 100% normal, and you’re crazy for not doing things exactly the way they do.

Because we all have vastly different situations.

There’s a LOT of context that goes into why my budget looks the way it does based on my life. Unfortunately, I couldn’t fit all that context in this newsletter.

But I promise you we will revisit this next week…

“Wait, I need MORE”

Here are my goals for this year, that I’d love you to be a part of:

Building a place for folks to learn how to manage their money.

Real talk about finances and actual budget breakdowns.

Regular live Budget Nights where we track our finances together (and tbh probably drink wine).

1:1 budgeting help, for those who’d find it helpful.

So far… None of these things exist in the Meet Your Money world.

But I’ll keep you updated, and let’s see where we land by the end of 2024 🙂