Honest question.

Let’s talk about it.

This week, meet:

➡️ The $118 cart at Target

➡️ The backlash to the car

➡️ The truth about grocery spending

The $118 cart at Target

Alright, so obviously that question was not honest at all. Worse, it was the resurrection of this meme that’s been dead for about a month.

I guess it’s less of a meme and more of a viral tweet. I don’t know. Those lines get blurred.

At any rate, this tweet encapsulates a feeling we’ve all had at one point: “How the hell did THIS cost THAT MUCH?”

It’s a result of several factors:

Inflation’s effect on our perception of fair pricing

Actual unfair pricing due to ✨capitalism✨

Sticker shock after you weren’t really paying attention to prices while shopping

But for about a week on the internet, this Target order came to symbolize more than that. It came to mean a lot of things for a lot of people — from the perceived naivety of young women to the “right” way to shop for groceries.

So now… We’re going to visit this Target cart discourse.

The backlash to the cart

There were 7 “types” of reactions to this post. Each one tells us something valuable — about how our culture thinks about the cost of living, personal finance, and rubber duckies.

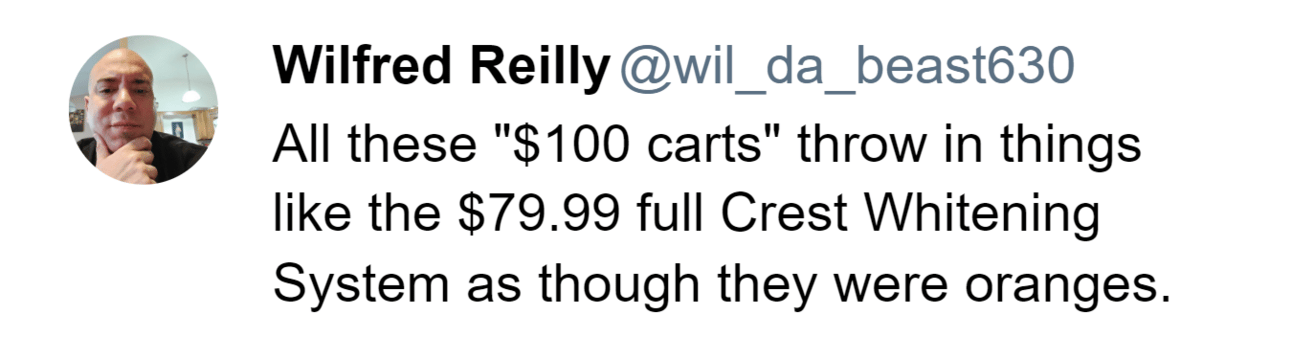

1. The “he’s not wrong, but I don’t like the attitude” response

There were a few replies that were more like “he IS wrong AND I don’t like the attitude,” but I did not choose violence today.

The vibe of this comment is, “Maybe if you weren’t a dumb woman, you wouldn’t be so bad with money!” Which is not something I’m interested in engaging.

However. In his defense.

It is a pretty random assortment of stuff. Stuff that isn’t particularly known for being cheap. Stuff that doesn’t make a super strong argument for the impact of inflation on groceries.

But also: was she trying to make an argument? Or did she just snap a quick picture to complain on the internet?

2. The “well if you didn’t buy such expensive crap” response.

I thought this guy had a point. Then I looked up the exact product he’s talking about, and it’s literally $11.99 at Target.

3. The “f*ck those first guys” response.

Oh, you got pomegranates? Maybe your cart wouldn’t be $118 if you got bananas instead. Why can’t you just get normal toothpaste? You don’t need those seasonings. Almond milk is always more expensive anyway.

And ultimately… Those arguments are meant to divert attention away from rising prices, and instead put 100% of the blame on the consumer for their choices.

4. The “fake news” response.

Where’s the lie? I don’t see a clear reason why this WOULDN’T be $118 from Target. It’s high enough to be surprising, low enough to not really sound fake.

5. The “inflation is legit” response.

Even if all the other responses are valid, we’re left with what ~feels~ true.

And that is, that sh*t’s way more expensive than it used to be. Across the board.

6. The “fr though why are you shopping at Target” response

I’m in this camp.

Yes, things are more expensive.

No, you can’t buy groceries at Target and then be stunned that it’s more than at it would be at a low-cost grocery store.

7. The “little things matter” response.

Consumerism be damned, I will defend this tomato-themed rubber ducky with my life.

The truth about grocery spending

This Twitter discourse is a microcosm of Americans’ feelings about on grocery spending. And, as an extension of that, of the economy at large.

While these feelings are important to the actual understanding of the economy (see: vibecession), it’s also helpful to look at some hard facts.

So let’s look at the good ol’ Bureau of Labor Statistics. They say:

Groceries that cost $100 in 2019 cost $125 now.

That’s an 25% increase in 4 years, or an average of 6.25% per year.

The cumulative rate of inflation during that time period was 19.2%, or averaged out at 4.8% per year (although bear in mind, the average inflation is ~3% and inflation peaked in 2022 at ~8%).

So based on this data, groceries got more expensive than most things by, approximately, a bit.

Here’s how my personal grocery costs have changed:

2019: per week = $32, per month = $128

2023: per week = $48, per month = $208

That’s around a 50-60%.

But - these numbers mean almost nothing. In 2019, I was finishing my last year of college, living with roommates, super broke, and didn’t keep a budget at all some months.

In 2023, I made the most money I’ve ever made in my life, split grocery costs with my partner, and had a Costco membership.

Life changes.

Inflation happens.

Anyway.

Do you know how much you’re spending on groceries?

Let me know.

Now, let’s get to the part where we talk tips.

3 things to do if you’re overspending on groceries

Don’t get groceries at Target.

That’s the core advice. There are 3 reasons why, and 3 ways to combat it:

Get granular with your tracking.

When you buy groceries… you’re not really just buying groceries. (See: makeup, gum detoxifier, rubber ducky, et al.)

So how do you get a handle on your actual grocery costs when your grocery store trips span 4 different categories of your budget?

The answer ain’t pretty, but it works: Save grocery receipts. Track and categorize each line item. You can use the Reverse Budget, but for groceries only.

It will help you see what categories you’re truly spending on. What was for household? What was for personal care? What was for the light bulb to replace the one in the fridge but you accidentally got the ones for ceiling fans so they didn’t even work anyway?

You’ll also be able to drill down on the groceries themselves. What was a shouldn’t have rather than a have to have? What was truly essential?

Do this for a month or two. Your habits will change. Pinky promise.

Deny convenience.

There’s such a thing as an “unofficial convenience fee,” and places like Target are certainly convenient.

Getting almond milk, makeup, pomegranates, a new shirt, and a tennis racket all at once? Hell yeah. Except the convenience means most of that stuff will be more expensive.

If your go-to is usually a big, convenient, pricey store, test a new system. Start at the cheapest store near you, get as much as you can from your list. Then work up to the next cheapest.

Places to start before you give up and go to Target, Kroger, or Safeway:

International grocery stores

Produce stands

Grocery Outlet

Winco

Aldi

Buy bulk.

This one sounds dumb, but don’t dismiss it.

If you have $5, you can buy 2 rolls of paper towels for $2.49 each.

But if you can spare $15, you can buy 8 bigger rolls for $1.87 each.

And if you can buy, beg, or cheat your way into a Costco membership, you’re looking at 12 rolls for $1.62 each. (Honestly, not Costco’s greatest deal, but every bit counts).

Buy your essentials in greater quantities. Make trips to quality membership warehouses like Costco. Visit the bulk aisle more often.

“Wait, I need MORE”

Here are my goals for this year, that I’d love you to be a part of:

Building a place for folks to learn how to manage their money.

Real talk about finances and actual budget breakdowns.

Regular live Budget Nights where we track our finances together (and tbh probably drink wine).

1:1 budgeting help, for those who’d find it helpful.

So far… None of these things exist in the Meet Your Money world.

But I’ll keep you updated, and let’s see where we land by the end of 2024 🙂