Last week, I shared what I spent for the entire year of 2023.

This week, I’m asking the question I’ve asked myself for decades…

Am I normal? What is “normal”?

This week, meet:

➡️ Normal vs Ideal

➡️ What really IS normal

➡️ The 3 R’s

Normal vs Ideal

“Normal doesn’t exist.”

I think the first time someone told me this, I took it as a feel-good platitude. In a, “we’re each a unique snowflake falling from the clouds of our lives” kind of way.

The more I’ve thought about it, though, I think it’s meant in a very literal way.

Normal doesn’t exist.

“Normal” isn’t a valid measurement. There’s average – adding all the things up then dividing by the number of things. There’s mode – the most common or repeated thing. And there’s median – the true center of the things.

Normal isn’t a statistical term, nor a meaningful one.

Jump down the rabbit hole with me for a sec, please…

“Normal” is the stick we measure all areas of our life against, but what we’re measuring against there is a fictional amalgamation of everything we’ve been led to believe “other people” are doing.

So maybe when we ask, “Am I normal?”, we’re really asking, “Am I roughly the same as everyone else?”

But if we’re asking whether our finances are normal, we’re often really asking, “Is my financial state ideal compared to that of other people at my stage of life?”

And when we ask THAT, we’re typically asking something like, “Am I making and saving as much as I should be by now?”

Aha, that’s the question.

And now that we’ve found the question, let’s talk about why it’s the wrong one to ask.

What really IS normal

The TL;DR of last week’s newsletter is that I earned $55,000, saved $26,000, and spent $29,000 in the Year of our Lord 2023.

To emphasize, I spent less than $30k last year.

Which, I dunno, seemed a little shocking?

Maybe those Kevin McAllister inflation TikToks got in my head last holiday season. Was 2023 like a stupidly expensive year to live through, and I’ve cracked the code? Or am I just normal?

What’s normal??

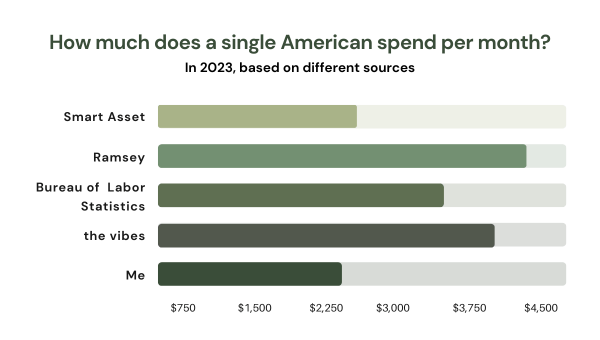

Well, it depends on who you ask:

Smartasset will tell you: “Basic expenses for a single adult with no children in the U.S. is $2,508” per month.

Dave Ramsey’s website says: “For single folks, the average monthly expenses are $4,337.”

But the Bureau of Labor Statistics feels like the place with the best statistics on this kind of thing, and they haven’t gotten together the numbers for 2023 yet. For 2022, though, looks like the average single American spent $3,558.

So my $2,483 per month was not too shabby.

But maybe you noticed something there… We’re measuring for “single Americans.” That doesn’t mean Americans who are out clubbing every weekend bumping Beyonce. This is tax-single — meaning, not legally married.

And actually, the metric I used from the BLS is even more riveting: “consumer units of one person.” Aka, you don’t pool income/expenses with anyone, you don’t have any kids, you don’t have anyone financially dependent on you.

The numbers above are nowhere NEAR normal for people with kids.

Which brings me back to the point…

Normal doesn’t exist.

Now we’ll get into exactly why…

The 3 R’s

We ALL have baggage. And 99.9% of us have privileges. At the same time.

Everyone is simultaneously disadvantaged in some ways and boosted in others.

To give it language, I think of these advantages and disadvantages as 3 R’s:

Restrictions

Resources

Rockets

☹️ Restrictions

Restrictions are the things that make financial health tougher for you. (Note: tougher, not impossible.)

There are a wide range of things that pull us down financially.

Some are willing sacrifices; for example, kids are hella expensive. Hopefully worth it, but still — it costs roughly $310,605 per child raised to age 17.

Other “restrictions” are objectively unpleasant. Like..

Credit card debt

Growing up poor

A pricey car payment

Pets (read: vet bills, rental deposits, etc)

No financial support system or safety net

🙂 Resources

Resources are the opposite of restrictions — these are the circumstances in life that enable you to have better finances. Sometimes these are plain luck, but they can also be carefully orchestrated.

For example, you might have a rich aunt who died and left you a chunk of money. (Sounds like luck to me… unless her death was mysterious? 🧐)

Or, you could have a fully paid-off car. Better yet, you could live in an area with awesome public transport and you own no car.

Other “resources” could be:

Splitting expenses with a partner

Solar panels to lower your electric bill

A budding YouTube channel that cashes out $1k/mo

Parents you can call on for help if sh*t hits the fan

🚀 Rockets

Rockets! These things are what they call, in the biz, “high leverage.”

Sure, having a cheap car would benefit your finances, but making a $50k higher salary would ROCKET your finances.

Rockets are big-picture things. They’re structures that foundationally increase or protect your money.

The highest leverage you can get in your personal financial life is:

Positioning yourself to make more money

Systematically saving the money you make

Using your money to… make more money (aka, investing)

“What do I care about your stupid R framework??”

Figure out your personal 3 R’s, and you’ll be unstoppable.

Your 3 Rs will absolutely demolish the “Am I normal?” question. You are not normal; you are a unique person living a unique life with unique circumstances.

It’s not helpful to scrutinize your finances by comparing yourself to others “like you.” There’s no one like you.

What IS helpful?

Name your current restrictions, resources, and rockets.

Brainstorm ways to reduce restrictions.

Enjoy your resources 😎

Relentlessly seek to increase your rockets

Do these four things for the next 11 months, and I guarantee your life will be changed.

My baggag— I mean, 3 R’s

Last week, I broke down my 2023 expenses. Sometimes people are transparent about their finances on the internet, and I kind of like that.

What I don’t like? When people on the internet are “transparent” about their finances, and then are immediately weirdly NOT transparent about all the context around it.

So I come before you this week, bearing context in the form of my 3 R’s:

Restrictions

I come from a “working class” family. (Which is code for “poor.”)

I didn’t start learning anything about money management / financial literacy until college.

Never been able to rely on a financial safety net from family.

Student loan debt✌️

Mental health, etc. (Aka, insurance doesn’t cover therapy).

I live in a relatively high cost of living area (by choice, but still).

Resources

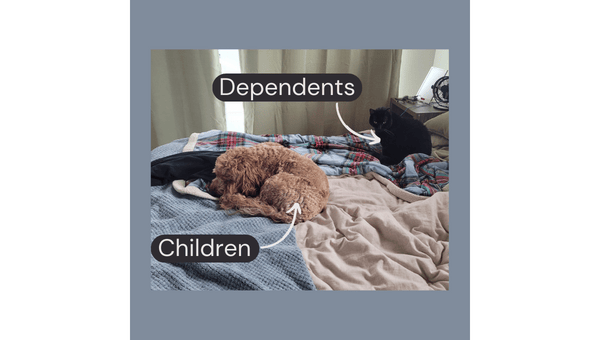

I don’t have children or dependents. (I also don’t cover many costs for my partner’s pets. Though I do love them as my own.)

I don’t have to commute to work (back when I did, it cost between $200 and $300 per month 💀)

I live with my partner, we split the cost of housing, groceries, and trips.

I own a house. (Granted, my mortgage is much higher than my previous rent, but I count it a win that my housing costs aren’t going 100% to a landlord.)

Rockets

I have a decent-paying job, with adult-y benefits like health insurance and a 401k.

I save 20-40% of my income every month, I’m never paycheck to paycheck or going into credit card debt.

I invest several hundred dollars a month in the stock market, and those investments grow my money bit by bit.

Note: this list is not comprehensive. Depending on my mood, I could explain how I’m immeasurably blessed or consumedly deprived. But you get the gist.

Now, it’s your turn.

“Wait, I need MORE”

Here are my goals for this year, that I’d love you to be a part of:

Building a place for folks to learn how to manage their money.

Real talk about finances and actual budget breakdowns.

Regular live Budget Nights where we track our finances together (and tbh probably drink wine).

1:1 budgeting help, for those who’d find it helpful.

So far… None of these things exist in the Meet Your Money world.

But I’ll keep you updated, and let’s see where we land by the end of 2024 🙂